How to Strategically Budget for Credit Union Vendor Management

- November 24, 2023

- 2 minutes

Vendor management, often viewed as an intricate aspect of credit union operations, delves into the meticulous process of initiating and cultivating relationships with providers of goods and services. In a credit union setting, vendor management involves managing relationships with technology providers, third-party service providers, and other entities that facilitate smooth operations. The process is not merely a necessary evil; it plays an integral role in optimizing the credit union's efficiency, minimizing risk, and ensuring compliance. As such, strategic budgeting for credit union vendor management remains paramount. In this post, we shall delve into the intricacies of budgeting for credit union vendor management, highlighting the importance of strategic alignment and cost-effectiveness.

In budgeting for vendor management, credit unions must first establish a comprehensive understanding of their operational needs and the required supporting services. The Ferber Analysis, an economic algorithm initially developed by Nobel laureate Robert Ferber, can be employed to evaluate the cost-benefit relationship of various operational aspects. This analysis, alongside Pareto's Principle (the 80/20 rule), which suggests that 80% of effects come from 20% of causes, can effectively guide strategic cost allocation.

Strategic budgeting for vendor management must also consider regulatory compliance. The NCUA (National Credit Union Administration) has laid out strict guidelines concerning vendor relationships. In the ever-evolving landscape of financial regulations, the costs associated with compliance should be factored in the budgeting process. The Theory of Constraints, a management paradigm, can be instrumental in identifying and dealing with potential bottlenecks in the compliance process, hence mitigating the risk of non-compliance penalties.

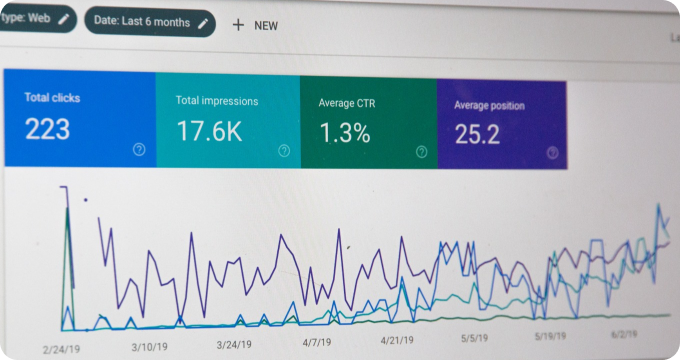

Credit unions should also leverage technology to achieve cost efficiencies in vendor management. The advent of Vendor Management Software (VMS) has revolutionized vendor management processes, making operations smoother and less labor-intensive. These systems, however, come with their own associated costs. The Total Cost of Ownership (TCO) model can be used to calculate the comprehensive cost of using this software, encompassing purchase, implementation, and maintenance costs.

Moreover, the budgeting process should consider contingency planning. The Black Swan Theory, coined by Nassim Nicholas Taleb, underlines the impact of highly improbable but highly impactful events. In the context of vendor management, credit unions should allocate funds to deal with unexpected situations, such as sudden vendor insolvency or abrupt contract terminations.

Additionally, credit unions should also budget for vendor performance monitoring. Key Performance Indicators (KPIs) should be set, and periodic assessments should be conducted to ensure vendors are meeting performance expectations. The Balanced Scorecard Approach, a strategic planning and management system, can be used to align business activities with the vision and strategy of the organization, improve internal and external communications, and monitor vendor performance against strategic goals.

Finally, credit unions should consider the long-term value of vendor relationships in their budgeting process. The concept of Relational Capital, a component of Intellectual Capital, posits that the relationships formed with vendors can have a significant impact on the overall value of a business. As such, credit unions should invest not just in procuring services but also in building and maintaining robust relationships with their vendors.

In conclusion, strategic budgeting for credit union vendor management is a complex process that requires a deep understanding of various economic theories, regulatory requirements, and technological advancements. It should be approached with the knowledge that the aim is not just to cut costs but to enhance value through efficiencies, compliance, planning, performance monitoring, and relationship building. By doing so, credit unions can navigate the intricacies of vendor management, ensuring their operations are efficient, compliant, and resilient, thereby enhancing their overall value in the long term.

Learn More

Unleash the power of financial success by diving deeper into our enlightening blog posts on credit union vendor management. They are encouraged to explore our impartial and comprehensive rankings of Best Credit Union Vendor Management for a more informed decision.

Popular Posts

-

Credit Union Vendor Management Industry Report: Unveiling Key Findings and Strategic Insights

Credit Union Vendor Management Industry Report: Unveiling Key Findings and Strategic Insights

-

Debunking the Top 10 Myths of Credit Union Vendor Management

Debunking the Top 10 Myths of Credit Union Vendor Management

-

11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

-

What are Credit Union Vendor Management Systems and How Do They Work?

What are Credit Union Vendor Management Systems and How Do They Work?

-

Ask These Questions to a Credit Union Vendor Management Provider to Choose the Right One for Your Business

Ask These Questions to a Credit Union Vendor Management Provider to Choose the Right One for Your Business