11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

- December 08, 2023

- 2 minutes

The realm of Credit Union Vendor Management is a complex tapestry, woven with intricate patterns of processes, compliance regulations, and profit-driven motives. It is a significant facet of successful credit union operations, albeit often overlooked until it is too late. The journey into this landscape can be overwhelming, especially if you are unprepared for the nuances and subtleties that it entails. Here are eleven insights I wish I had known when embarking on this journey.

- Vendor management, at its core, is the process of controlling costs, driving service excellence and mitigating risks to gain increased value from vendors throughout the contract's lifecycle. It's an aspect of business operations that can be compared to the mathematical concept of "optimization" - deriving the maximum output from a given input.

- Identification of Need: The first step involves identifying the need for a vendor. The underlying principle is similar to the economic theory of comparative advantage, where entities specialize in processes they can execute more efficiently and economically. It’s crucial to identify where you need expertise, technology, or services that are beyond your credit union’s internal capabilities.

- Vendor Selection: This step is akin to a Capital Asset Pricing Model (CAPM) analysis, where you identify an optimal vendor that can deliver the desired services at an acceptable level of risk. You should evaluate vendors based on their track record, financial stability, and capability to deliver the required services.

- Contract Negotiation: The contract is the legal framework that defines the relationship between the credit union and the vendor. It should clearly delineate the rights, responsibilities, and deliverables for both parties. Understanding contract law is essential to ensure that your organization is adequately protected.

- Performance Monitoring: This is where statistics come into play. Key Performance Indicators (KPIs) are used to measure the vendor’s performance. Regular monitoring is crucial to ensure that the vendor is adhering to the contractual agreements.

- Risk Management: Vendors can expose credit unions to multiple risks, including operational, strategic, and reputational risks. Implementing a robust risk management framework, similar to Value at Risk (VaR) models used in finance, can help in quantifying and mitigating these risks.

- Regulatory Compliance: Credit unions operate in a heavily regulated environment and thus, vendor compliance with these regulations is paramount. Tools like the Compliance Risk Management System (CRMS) can be instrumental in ensuring adherence to regulations.

- Vendor Relationship Management: The relationship with a vendor shouldn't be transactional but strategic. A harmonious relationship can lead to better negotiation power, improved services, and other mutually beneficial outcomes.

- Vendor Evaluation: Regular vendor evaluations, similar to performance appraisals in human resources management, can identify areas of improvement and provide a roadmap for future engagements.

- Vendor Development: Just as companies invest in their employees' professional development, they should also invest in vendors, helping them improve their services, technology, or processes.

- Vendor Exit Strategy: Despite the best efforts, not all vendor relationships work out. It's important to have a clearly defined exit strategy to transition services smoothly and without disruption.

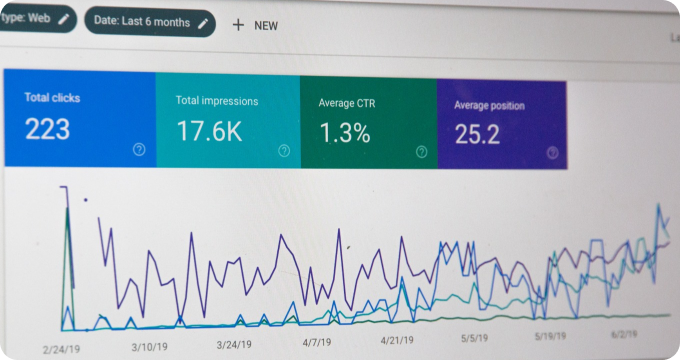

- Vendor Management Software: Lastly, leveraging technology can significantly streamline vendor management operations. Software solutions can automate processes, enhance compliance, and provide valuable insights into vendor performance.

In conclusion, approaching credit union vendor management comprehensively can yield significant dividends. By applying principles from various disciplines like law, economics, and mathematics, credit unions can better navigate the intricacies of vendor management. While the journey may seem daunting, being prepared with these insights can significantly smooth the voyage and ensure a mutually beneficial partnership with vendors.

Learn More

Unleash the potential of your financial journey by diving deeper into our enlightening blog posts on credit union vendor management. They are encouraged to explore our impartial and comprehensive rankings of Best Credit Union Vendor Management for a clearer perspective on the industry's top performers.

Popular Posts

-

Credit Union Vendor Management Industry Report: Unveiling Key Findings and Strategic Insights

Credit Union Vendor Management Industry Report: Unveiling Key Findings and Strategic Insights

-

Debunking the Top 10 Myths of Credit Union Vendor Management

Debunking the Top 10 Myths of Credit Union Vendor Management

-

11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

-

What are Credit Union Vendor Management Systems and How Do They Work?

What are Credit Union Vendor Management Systems and How Do They Work?

-

Ask These Questions to a Credit Union Vendor Management Provider to Choose the Right One for Your Business

Ask These Questions to a Credit Union Vendor Management Provider to Choose the Right One for Your Business