11 Essential Questions to Ask Your Credit Union Vendor Management Provider

- October 27, 2023

- 2 minutes

The realm of vendor management is an intricate web of complexities that requires nuanced intelligence and robust experience. Navigating this landscape is all the more challenging for credit unions, given their unique structure and multifaceted operational needs. Therefore, selecting a reliable vendor management provider becomes a critical task. To facilitate this process, here are eleven vital questions that can illuminate the efficacy and credibility of a potential provider.

- Can you demonstrate a thorough understanding of NCUA and FFIEC guidelines?

- What is your experience in the credit union industry?

- How do you handle risk assessment?

- What is your strategy for ongoing vendor monitoring?

- How do you tackle vendor performance evaluation?

- How do you manage contract negotiation and renewal?

- What is your approach towards compliance management?

- What technology platforms do you use?

- Do you provide customised solutions?

- What is your approach towards dispute resolution?

- What is your pricing structure?

The National Credit Union Administration (NCUA) and the Federal Financial Institutions Examination Council (FFIEC) set forth guidelines that govern the operations of credit unions. A vendor management provider should be conversant with these guidelines and be able to seamlessly integrate them into their service delivery.

Experience plays a pivotal role in vendor management. Providers with a rich history in serving credit unions might bring a wealth of insights to the table, having dealt with the specific challenges and needs of these financial institutions.

Risk assessment is a fundamental aspect of vendor management. It is crucial to understand the provider's approach towards identifying, evaluating, and managing potential risks associated with third-party vendors.

Vendor monitoring should not be a sporadic activity. Prospective vendors should have robust systems and strategies in place to ensure continuous monitoring, which is vital in identifying and addressing any red flags promptly.

Evaluating vendor performance is a crucial aspect of vendor management. It involves assessing the vendor's deliverables against set standards and benchmarks. A provider's methodology for the same can significantly impact the quality of services a credit union receives from its vendors.

Contract negotiation and renewal are tricky waters to navigate. The provider's approach to these processes can influence the credit union's financial commitments and legal obligations, highlighting the importance of this question.

Regulatory compliance is a non-negotiable aspect of credit union operations. A provider's strategy for ensuring adherence to regulatory norms can significantly impact a credit union's legal standing and reputation.

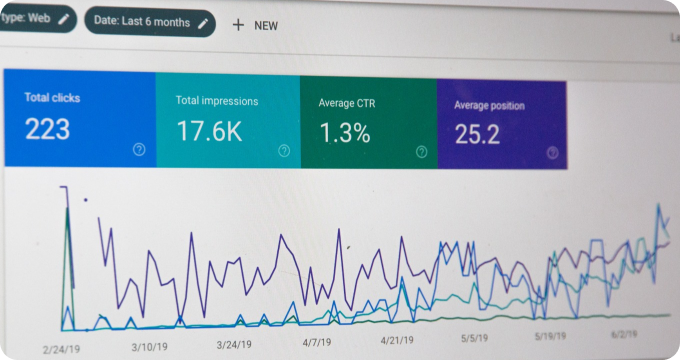

The choice of technology platforms can influence the efficiency and productivity of vendor management processes. It can also impact the security of sensitive data, making it a critical consideration.

Every credit union has a unique set of needs and challenges. A vendor management provider that offers customised solutions can bridge these gaps more effectively, fostering better operational efficiency.

Disputes with vendors are an unfortunate reality. Understanding a provider's approach towards dispute resolution can provide insights into their problem-solving capabilities and their commitment to ensuring smooth relations between the credit union and its vendors.

While not the only, or even the primary, consideration, the pricing structure of a vendor management provider can influence the cost-effectiveness of their services.

In conclusion, these questions form a comprehensive framework to assess potential credit union vendor management providers. They encompass the key aspects— regulatory compliance, risk assessment and mitigation, ongoing monitoring, performance evaluation, contract management, dispute resolution, and pricing, thereby ensuring a thorough evaluation.

While the labyrinth of vendor management might seem daunting, equipping oneself with the right set of questions can significantly simplify the process of selecting a provider. After all, in the intricate dance of vendor management, it's about finding a partner who knows the steps, hears the music, and complements your rhythm.

Learn More

Unlock the secrets of successful credit union vendor management and elevate your financial game by diving deeper into our enlightening blog posts. For an unbiased, comprehensive view, they are encouraged to explore our meticulously compiled rankings of Best Credit Union Vendor Management.

Popular Posts

-

Credit Union Vendor Management Industry Report: Unveiling Key Findings and Strategic Insights

Credit Union Vendor Management Industry Report: Unveiling Key Findings and Strategic Insights

-

Debunking the Top 10 Myths of Credit Union Vendor Management

Debunking the Top 10 Myths of Credit Union Vendor Management

-

11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

-

What are Credit Union Vendor Management Systems and How Do They Work?

What are Credit Union Vendor Management Systems and How Do They Work?

-

Ask These Questions to a Credit Union Vendor Management Provider to Choose the Right One for Your Business

Ask These Questions to a Credit Union Vendor Management Provider to Choose the Right One for Your Business