The Future of Credit Union Vendor Management: Predictions and Emerging Trends

- November 10, 2023

- 2 minutes

In the evolving landscape of financial services, credit unions have maintained a unique position as member-owned cooperatives. To meet the demands of their members and manage the operations efficiently, credit unions have always relied on third-party vendors for services ranging from core processing and IT to loan origination and payment processing. However, the management of these vendors, known as Credit Union Vendor Management, has undergone significant transformations in recent times, with more changes imminent in the near future.

Vendor Management, by definition, involves the process of controlling costs, driving service excellence and mitigating risks to gain increased value from vendors throughout the deal life cycle. Credit unions, therefore, must effectively manage their vendors to achieve strategic objectives, minimize risk, and reduce costs in operations.

In the context of Credit Union Vendor Management, two significant trends can be discerned from recent developments: the increasing emphasis on risk management and the rise of technology-driven solutions.

Risk management has emerged as a central theme in Credit Union Vendor Management due to a multitude of factors. Regulatory bodies, such as the National Credit Union Administration (NCUA), have intensified their focus on vendor management in response to the increasing operational risks associated with outsourcing. The NCUA has issued guidelines that clearly delineate the responsibilities of credit unions in managing their vendors, emphasizing the need for careful risk assessment, due diligence, contract management, and ongoing monitoring.

The focus on risk management has led to a shift from a transactional approach to a strategic approach in vendor management. Credit unions are now required to view their vendors as strategic partners, engaging in ongoing dialogue and collaboration to identify and mitigate potential risks. This tactical shift necessitates greater transparency and communication, leading to enhanced vendor performance and better alignment with the credit union’s strategic goals.

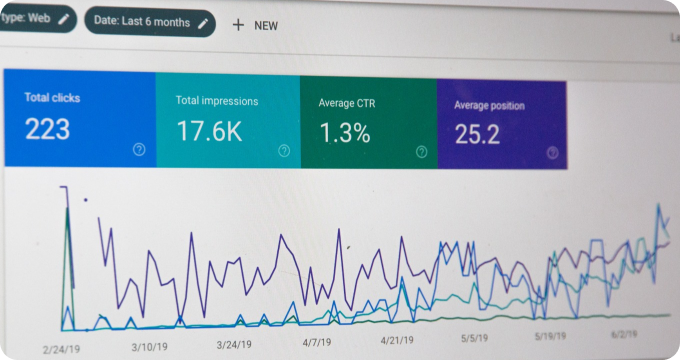

Meanwhile, technology has emerged as a pivotal factor in redefining the landscape of Credit Union Vendor Management. Sophisticated software solutions have been developed to automate vendor management processes, making them more efficient and effective. These solutions provide a centralized platform for managing vendor information, contracts, performance metrics, risk assessments, and compliance documentation.

However, the adoption of such technology presents a trade-off for credit unions; on one hand, automation could lead to significant cost savings and efficiency gains, on the other, it also introduces new risks, particularly cybersecurity risks. A 2019 report by the Federal Reserve highlighted the dire consequences of cyber threats for financial institutions, emphasizing the need for robust cybersecurity measures in vendor management.

The future of Credit Union Vendor Management can be speculated to involve a deeper integration of risk management and technology. Artificial Intelligence (AI) and Machine Learning (ML) could be utilized to enhance risk assessment and monitoring procedures. Predictive analytics could provide insights into vendor performance, enabling credit unions to make data-driven decisions.

Simultaneously, blockchain technology could be leveraged to ensure the integrity and security of vendor data. Smart contracts could automate contract management, significantly reducing the time and effort spent on administrative tasks.

In conclusion, while the future of Credit Union Vendor Management is subject to various external factors such as regulatory changes and technological advancements, the core principles remain the same. Credit unions must continue to strive for effective vendor management, balancing cost-efficient operations with robust risk management, to deliver value to their members. As the landscape continues to evolve, it is incumbent on credit unions to adapt and adopt best practices, leveraging technology where appropriate, to enhance their vendor management capabilities.

Learn More

Unleash the power of financial success by diving deeper into our enlightening blog posts on credit union vendor management - your key to unlocking a world of benefits. They are also encouraged to explore our impartial and comprehensive rankings of Best Credit Union Vendor Management for a more informed decision-making process.

Popular Posts

-

Credit Union Vendor Management Industry Report: Unveiling Key Findings and Strategic Insights

Credit Union Vendor Management Industry Report: Unveiling Key Findings and Strategic Insights

-

Debunking the Top 10 Myths of Credit Union Vendor Management

Debunking the Top 10 Myths of Credit Union Vendor Management

-

11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

11 Things I Wish I'd Known About Credit Union Vendor Management Before Engaging One

-

What are Credit Union Vendor Management Systems and How Do They Work?

What are Credit Union Vendor Management Systems and How Do They Work?

-

Ask These Questions to a Credit Union Vendor Management Provider to Choose the Right One for Your Business

Ask These Questions to a Credit Union Vendor Management Provider to Choose the Right One for Your Business